Everything we knew about wedding insurance crumbled when the Covid-19 pandemic entered our lives. It was an unexpected revelation for a lot of couples that their wedding insurance policy didn’t cover cancellation and postponement because of coronavirus – and we can’t blame insurance companies, as, otherwise, they would go bankrupt in an instant! But what we can do is learn to live in new realities, find compromises, and do the research to choose the best possible option for the wedding insurance market. And our goal is to help you with those tasks.

Everything we knew about wedding insurance crumbled when the Covid-19 pandemic entered our lives. It was an unexpected revelation for a lot of couples that their wedding insurance policy didn’t cover cancellation and postponement because of coronavirus – and we can’t blame insurance companies, as, otherwise, they would go bankrupt in an instant! But what we can do is learn to live in new realities, find compromises, and do the research to choose the best possible option for the wedding insurance market. And our goal is to help you with those tasks.

Related articles:

Top-5 best US insurance companies. Let’s choose optimal wedding insurance for you

What do you need to know about wedding insurance coverage?

Brides and grooms ask. Wedding insurance in Q&A

What else – except for buying wedding insurance – can you do to protect your wedding from mishaps?

There are approximately 2.5 million weddings every year across the United States. By itself, the industry is worth an estimated $55 B, according to a study from 2017, which was way before the industry (and the whole world) took an unprecedented turn due to this year’s coronavirus pandemic which struck the US and global economies hard and sent millions of people to the unemployment line.

Let’s think about those numbers for a second… 2.5 million weddings, that’s around 208K ceremonies per month, and close to 115 million tons of flower arrangements per year. Now think about how many people had to cancel or postpone their events when the pandemic started – unimaginable.

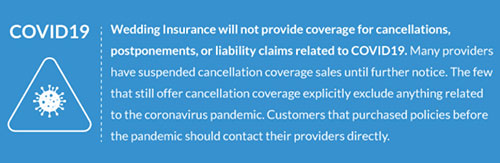

The truth is, the majority of insurance providers never thought we’d be in this situation, and so thousands of couples have had to face the grim realization of missing out on their big day and not having the coverage to fall back on to help cover the losses. Couples all over the country are scrambling to reschedule their weddings to the uncertain times that lie ahead of us in order to save their dreams of a perfect nuptial, and others have opted to adjust their ceremonies to the limitations of new social distancing requirements and lockdown measures.

Wedding insurance alone has become a hot topic during the pandemic, as more and more people have become frustrated with their providers, because “global pandemics” are typically not included in the fineprint.

ConsumersAdvocate.org has recently created an in-depth study that compares the top US insurance providers in an attempt to advise couples that are still considering tying the knot during this time. Their study breaks down coverage and eligibility options, pricing, and customer service ratings during the pandemic for those that consider customer service a top priority.

Taking into consideration the facts and numbers listed above, we’ve decided to make – together with ConsumersAdvocate.org team – a block of articles dedicated to wedding insurance during the coronavirus pandemic. We want to help our readers cope with the current complicated situation and offer you as many useful info, advice, and tips regarding wedding insurance as we physically can.

In the next materials of this block, you’ll read about:

- top-5 US insurance companies and their coverage. We’ll review and compare their offers for you to easily pick the right one for you;

- useful information about wedding insurance in general, with numbers and important detail;

- if you need wedding insurance at all and why;

- helpful advice how to get the most from your wedding insurance in case something goes sideways;

- wedding insurance pitfalls;

- and other really useful and important info on this topic.

Related articles:

Top-5 best US insurance companies. Let’s choose optimal wedding insurance for you