Weddings are expensive. According to The Knot, the average wedding cost in the US is around $33,000. When you’re spending so much, it’s important to mitigate the risks, and the best way to do it is to get good wedding insurance. We aim to help you pick the best possible option among dozens of wedding insurance providers available in the US. Here are the top-5 insurance companies that provide the finest coverage. Let’s compare their offers.

Weddings are expensive. According to The Knot, the average wedding cost in the US is around $33,000. When you’re spending so much, it’s important to mitigate the risks, and the best way to do it is to get good wedding insurance. We aim to help you pick the best possible option among dozens of wedding insurance providers available in the US. Here are the top-5 insurance companies that provide the finest coverage. Let’s compare their offers.

Related materials:

Is it realistic to get good wedding insurance during the Covid-19 pandemic? We’ll teach you how!

What do you need to know about wedding insurance coverage?

Brides and grooms ask. Wedding insurance in Q&A

What else – except for buying wedding insurance – can you do to protect your wedding from mishaps?

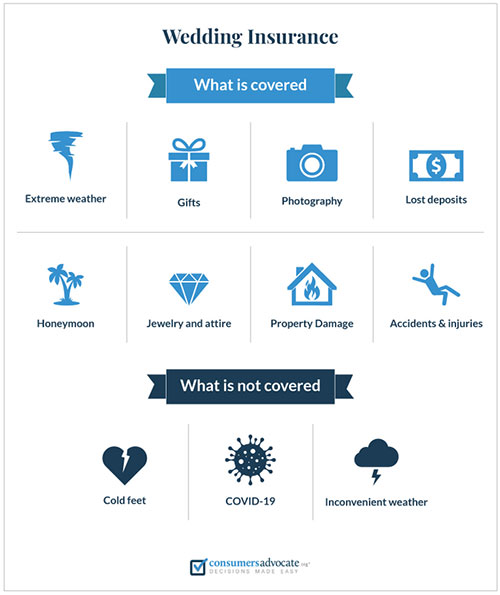

While insurance companies don’t cover the cancellation or postponement of weddings related to COVID-19, there are so many other issues they do cover. For example, lost deposits, property damage, injuries to the couple or guests at a wedding, wedding dress damages, etc. You can’t protect your wedding from coronavirus, but you can be ready for other mishaps and get coverage or money back in case something goes sideways. So, don’t rush to say “no” to wedding insurance. COVID-19 is by far not the only threat.

Our partner ConsumersAdvocate.org created a top-5 list of best wedding insurance companies and their coverage options. They’ve vetted 13 major players on the market and chose 5 companies with the best wedding insurance policies.

Markel

Markel focuses on specialty insurance and offers both liability and cancellation coverage for your wedding. Customers can purchase insurance under the category of Private Event for a single event (ceremony, reception, rehearsal dinner, or shower) or the Wedding category, which includes coverage for all four events under a single policy.

While they also offer coverage for international locations, some locations only qualify for cancellation coverage. Liability coverage extends only to US states and territories, and Canada. Cancellation coverage has a broader range that includes the UK, Mexico, The Bahamas, Bermuda, the Caribbean (except Cuba), and cruise ships departing from any of the locations listed.

Premiums start at $150 for the first level of liability coverage, including Host Liquor Liability, at no additional cost. However, if there will not be any alcohol served at your event, you can forfeit this for a lower premium cost. You can purchase a policy with liability coverage up to one day before the event, and add basic cancellation coverage of $5,000 for the added price of $50. However, even with the said extension, the policy will not be as comprehensive as purchasing Markel’s Cancellation Coverage Package.

The Cancellation Coverage Package starts at $130 and includes coverage for cancellation, postponement, extra expenses, photography, special attire, special jewelry, lost deposits, and professional counseling. Markel offers a 15% premium discount when you bundle this with a liability policy. Customers can purchase cancellation coverage up to 14 days before the event.

Markel charges a $25 deductible for each cancellation coverage section (photography, deposits, vendor issues, etc), and a $1,000 deductible for property damage under liability coverage.

eWed Insurance

EWed’s standout offering is Micro Wedding Insurance for weddings with expenses that do not exceed $5,000. This policy includes all the features of their standard cancellation coverage for a one-time payment of $75, with no deductible fees.

There is no international coverage available for cancellation or liability policies. The coverage area includes the United States and U.S. Territories (PR, U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands). Standard cancellation coverage starts at $10,000 for $139, up to a $100,000 limit.

You can purchase both policies up to one day before the wedding, but claims related to weather conditions are excluded if you purchase cancellation less than 14 days before the event.

WedSafe

WedSafe offers six coverage levels for liability policies, starting at $500,000 and going up to $5,000,000 – they offer the highest coverage limit on our list. Also, while many other providers limit liability coverage up to 2:00 am, WedSafe extends coverage up to 24 hours after that deadline, if the party goes on till the wee hours of the morning – provided the event is still at the location listed on your insurance documents.

Liability premiums start at $150 and cover both the damage to premises rented and any medical expenses. Liability policies can be purchased individually, with a 15% discount if bought in conjunction with cancellation and postponement coverage, including insurance for extra costs, photographs & video, gifts, special attire and jewelry, and professional counseling.

Insurance is available for events and cruise ships departing from all US states, Canada, Puerto Rico, and any other territory or possession of the United States at no additional cost. For a 10% surcharge, cancellation coverage can be extended to locations in the UK, Mexico, The Bahamas, Bermuda, and the Caribbean Islands (excluding Cuba).

You can purchase liability insurance online up to your actual wedding day, and cancellation coverage up to 15 days before the event. Claims can only be made via telephone by calling the Claims Department at K&K Insurance.

Wedsure

Wedsure is ideal for couples who want to insure specific elements of their event – think coverage for special attire, rings or photographs. Coverage for liability, cancellation, or both, starts at $125 and increases depending on the add-ons, with a separate deductible charge for each coverage category.

Cancellation coverage can go up to $250,000-maximum and may include honeymoon costs. Special add-ons include lost deposits, photographs and video, special attire, jewelry, gifts, rented party supplies, professional counseling, and medical payments. Photography coverage can even allow you to retake and re-stage parts of the wedding if the photographer failed to show up.

Wedsure is the only company on our list that offers a “change of heart” add-on, providing coverage for third parties affected by the couple’s choice to cancel the event. However, it does not cover the couple’s expenses.

Purchasing a policy, requesting changes, and filing a claim can all be done online. The website’s interface is easy to use with step by step guidelines on how to complete the process. There is also the option to apply for a full refund up to 48 hours before the covered event.

Wedding Protector Plan

Wedding Protector Plan is ideal for couples planning a destination wedding, as its coverage area includes the following at no additional cost: U.S. territories, Canada, United Kingdom, Bermuda, the Bahamas, Turks & Caicos, and the Caribbean Islands (excluding Cuba & Haiti). It also covers cruise ships departing from a port within these territories.

The core coverage has three available levels for cancellation and postponement. The first covers up to $7,500 for a premium of $160, and the third level covers up to $25,000 for $255. Liability policies are an optional add-on that offers coverage for up to $1,000,000 for all three levels. The main difference between each level is the Property Damage sublimit, which is $25,000 at the first level and $1,000,000 at the third level. The liability policy premium will depend on the level you chose, and Host Liquor Liability is a $50 add-on.

While there is no deductible fee for liability or cancellation claims, this does translate to higher premiums. You can purchase coverage as late as 24 hours before the event in most states, and there are no refunds except for New York, New Hampshire, and Oregon residents. Lastly, claims can only be made by telephone with their 24/7 customer service representative.

Related materials:

Is it realistic to get good wedding insurance during the Covid-19 pandemic? We’ll teach you how!